Which Describes Annual Income Guidelines Established by the Federal Government

While the guidelines stop at households of eight additional people are counted by adding 4500-5700 to the allowable household annual income. For family units with more than eight members add the following amount for each additional family member.

Understanding Medical Coding And Billing Chapter 15 Medicaid Flashcards Quizlet

The poverty guidelines are sometimes loosely referred to as the federal poverty level FPL but that phrase is ambiguous and should be avoided especially in situations eg.

. The proposed housing goals are designed to ensure the Enterprises responsibly promote equitable access to affordable housing that reaches low- and moderate-income families minority communities. Federal poverty level bmedically needy Medicaid program c. Government to indicate the least amount of income a person or family needs to meet their basic needs.

The poverty guidelines are sometimes loosely referred to as the federal poverty level FPL but that phrase is ambiguous and should be avoided especially in situations eg. The guidelines are a simplification of the poverty thresholds for use for administrative purposes for instance determining financial eligibility for certain federal programs. Federal income tax is based on your annual income while state income tax is generally a specific percentage of federal.

Federal poverty level b. Law 111-352 Government Performance and Results Act Modernization Act of 2010 GPRAMA. Federal poverty level Which program added prescription medication coverage to the original Medicare plan some Medicare cost plans some Medicare private fee-for-service plans and Medicare medical Savings Account Plans.

For example the poverty level for a household of four in 2022 is an annual income of 27750. In order to fund the Civil War the Revenue Act of 1862 imposed a 3 tax on the incomes of citizens earning more than 600 per year and 5 on those making over 10000. Which of the following is TRUE regarding the federal income tax liability owed.

Which describes annual income guidelines established by the federal government. After the law was allowed to expire in 1872 the federal government depended on tariffs and excise taxes for most of its revenue. Which describes annual income guidelines established by the federal government.

The term low-income individual means an individual whose familys taxable income for the preceding. The History of Measuring Poverty in America. Supplemental Security Income d.

Federal income tax is based on your annual income while state income tax is determined by the number of children the taxpayer has d. Today the Federal Housing Finance Agency FHFA proposed housing goals for Fannie Mae and Freddie Mac the Enterprises for 2022 to 2024. People whose income falls below the specified amount are considered poor.

Introduction to the Federal Budget Process. Medically needy Medicaid program c. Moreover a family of four that earns 26000-33000 per year is currently considered to be living at the poverty level.

Terms in this set 23. Question Which describes annual income guidelines established by the federal government. Annual performance plans and reports pursuant to Pub.

7080 for the 48 contiguous states the District of Columbia and outlying jurisdictions. Supplemental Security Income dTemporary Assistance for Needy Families. Federal Poverty Guidelines Charts for 2021 and 2022.

The Congressional Budget Act of 1974 lays out a formal framework for developing and. Both poverty thresholds and poverty guidelines are based on the official poverty measure established by the US. To get the poverty level for larger families add 4720 for each additional person in the household.

The HHS issues poverty guidelines for each household size. This backgrounder describes the laws and procedures under which Congress decides how much money to spend each year what to spend it on and how to raise the money to cover some or all of that spending. In accordance with the established income guidance the revised WIC income eligibility guidelines are to be used in conjunction with the WIC regulations at 7 CFR 2467d.

There is no relationship between federal and state income taxes. A flat tax of 10 is owed on all proceeds. Annual evaluations and reports pursuant to the Federal Information Security Modernization Act of 2014 PDF and OMB Circular A-130.

The guidelines are a simplification of the poverty thresholds for use for administrative purposes for instance determining financial eligibility for certain federal programs. The FPL is a measure of income issued annually by the federal Department of Health and Human Services that takes into account the number of people living in a household. And 8145 for Hawaii.

The annual revision for 2021 was published by the Department of Health and Human Services HHS at 86 FR 7732 on Feb. Which describes annual income guidelines established by the federal government. Below are the Departments annual adjustments to the Income Eligibility Guidelines IEGs to be used in determining eligibility for free and reduced price meals or free milk.

Temporary Assistance for Needy Families TANF makes cash assistance available on a time-limited basis for children deprived of support because of a parents death incapacity absence or unemployment. Poverty thresholds and poverty guidelines are dollar amounts set by the US. For example in 2022 the FPL is 13590 for an individual 18310 for a family of.

Research Analysis Background. Temporary Assistance for Needy Families Question 10. These guidelines are used by schools institutions and facilities participating in the National School Lunch Program and USDA Foods in Schools School Breakfast Program.

Income guidelines established annually by the federal government. A copy of the very first IRS 1040 form can be found at the IRS website showing that only those with annual incomes of at least 3000 equivalent to 78600 in 2020 were instructed to file the income tax return. Annual reviews and reports pursuant to Pub.

Kentucky Fha Loan Requirements For 2022 Fha Loans Fha Fha Mortgage

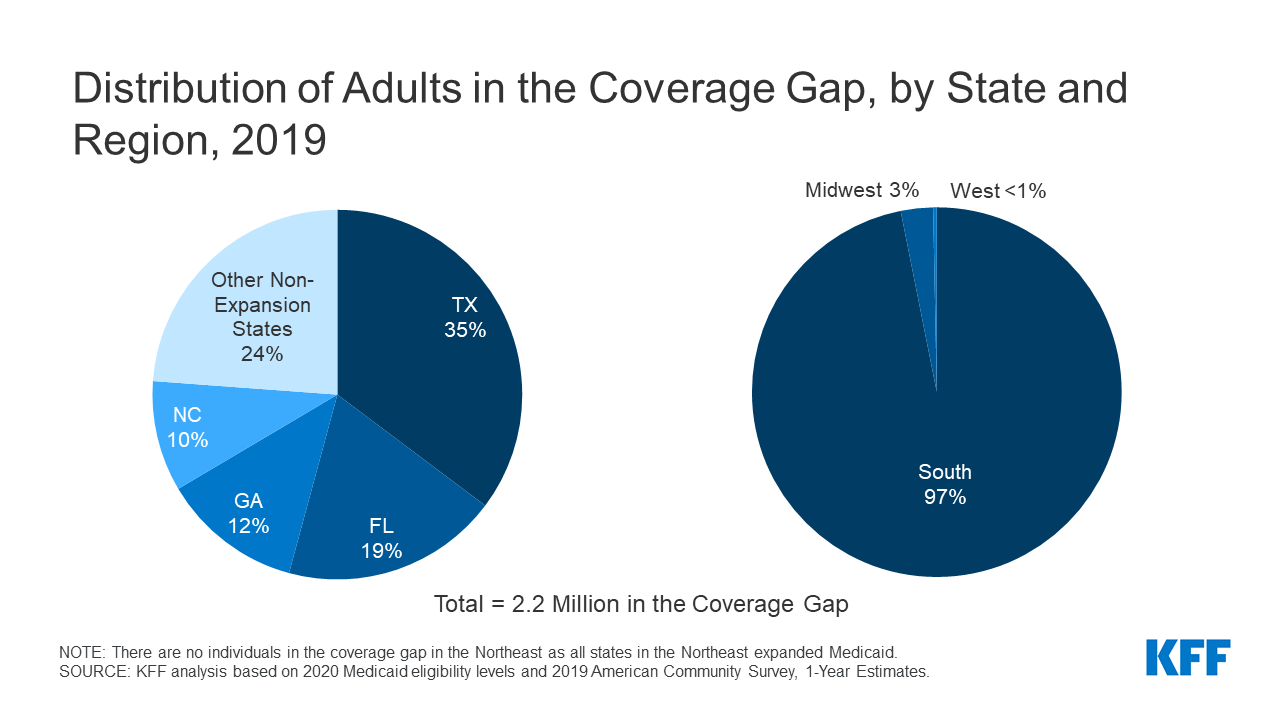

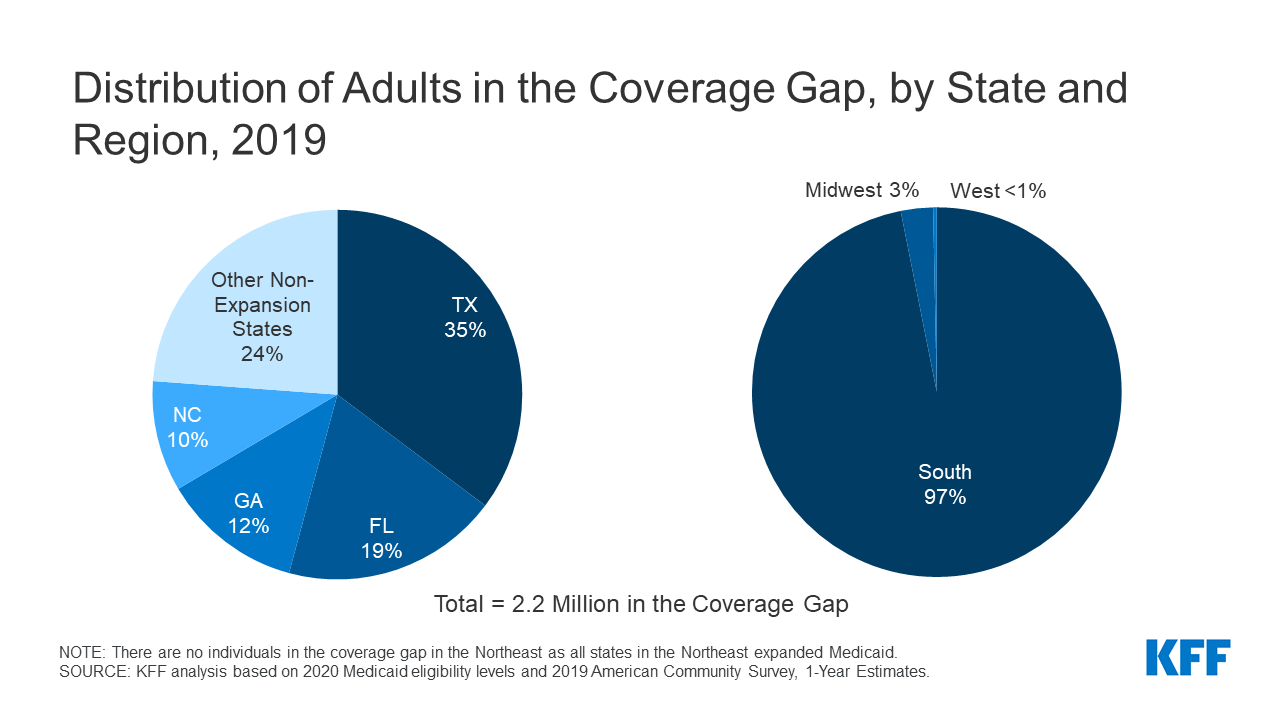

The Coverage Gap Uninsured Poor Adults In States That Do Not Expand Medicaid Kff

Comments

Post a Comment